What better way to kick off the new year than by sharing the results of another marketing tech stack analysis? This is the second analysis we conducted on the financial industry; we specifically analyzed the websites of the largest U.S. banks by asset size.

To conduct this analysis, we scanned these websites by using Tag Inspector, InfoTrust’s proprietary tag auditing, governance, and monitoring platform. Tag Inspector gave us a complete overview of every marketing platform loading across these sites, as well as the data parameters being collected and cookies being set.

In this article, we’ll share the following:

- The top analytics platforms used

- The top tag management systems used

- The top a/b testing platforms used

- The top consent management platforms used

- The number of total platforms found loading

On top of that, we’ll provide some things to consider as we approach the privacy-centric future.

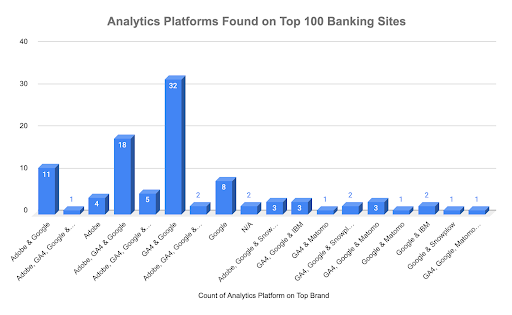

Top Analytics Platforms

Starting off, we took a look at the different analytics platforms used by these banking organizations. As we slowly approach the privacy-centric future, utilizing an analytics platform will be critical to the success of your analytics and digital marketing program.

With Tag Inspector’s scanner module, we were able to identify the following platforms used for measuring and tracking key customer journeys and conversions. Before that, we want to call out two things:

- Tag Inspector is unable to distinguish whether a website uses Google Universal Analytics free or Google Universal Analytics 360 (GA360), so they will both be classified as Google Analytics.

- As Google Analytics 4 (GA4) is a separate platform from Google Analytics, we counted them separately from each other in this analysis.

We found:

- Adobe Analytics loading on 44% of all websites

- Google Analytics on 93% of all websites

- GA4 on 68% of all websites

- IBM Analytics on 6% of all websites

- Matomo Analytics on 8% of all websites

- No analytics platforms on 2% of all websites

- Snowplow Analytics on 13% of all websites

Over the past few years of doing this analysis, we’ve found it more common for organizations (including banking institutions) to utilize more than one analytics platform. Two of the top reasons that come to mind are a) different teams use different platforms for different purposes, i.e. one to measure their digital marketing effectiveness and one to measure their user’s web experience, and b) the company is in the process of migrating from one platform to another, so they’re running both at the same time to understand the similarities and differences between the two.

One of the oddities that stood out to us was that there is still not a 1:1 ratio of organizations using both GA4 and Google Analytics alongside each other. The reason this is odd is because GA4 will become the new standard for analytics moving forward, and Google Analytics is slated to deprecate in the next 12-15 months (if you’re using Google Analytics free, you have until July 1, 2023!).

We may need to keep in mind that some of these institutions are migrating to a different platform instead, i.e. Adobe or Snowplow. However, for the organizations that still plan on using Google as their source of truth, the time to implement GA4 was yesterday. If you’re not currently using GA4 today, we highly recommend putting the tag on your website ASAP and start collecting data.

You will also need to start thinking about the impact of Google’s timeline down the road, i.e. how will we save our historical data before it goes away, how do we rebuild our dashboards, etc. For this, we would recommend looking into working with a partner that has years of experience with the Google ecosystem.

There is another caveat to call out that we’re seeing within the industry. As of today, Safari and Firefox have phased out using third-party cookies, which were created with the intent to remember user preferences and information for future visits/targeting. On top of that, Google will be deprecating their allowance of third-party cookies at the end of 2024.

What does this mean for banking organizations? It’s going to be significantly harder to identify and target key audiences that may be visiting their websites to create a savings account or to apply for a loan. This is why it’s imperative that these banks (and your company for that matter) have an analytics platform in place and set up to collect the data parameters needed to make data-driven decisions. You will have to rely heavily on your first-party data to make these choices moving forward.

Here are our other recommendations for optimizing your analytics platform:

- Conduct an analytics audit to better understand which analytics platforms you’re currently using and how they’re being used (what parameters are being collected, what pages are they loading on, etc.).

- If you’re using GA4, consider conducting a compliance audit and implementation to ensure it’s collecting data and is compliant with the different regulations that can impact it, i.e. California’s privacy act, Colorado’s, etc.

- If you’re using more than one enterprise analytics platform, make sure there’s a reason behind it; having more than one can bring more complexity across all teams involved.

- Consider hiring an experienced consultancy to help ensure you’re maximizing your analytics platform usage. Check out this checklist of things to consider when looking at an analytics partner.

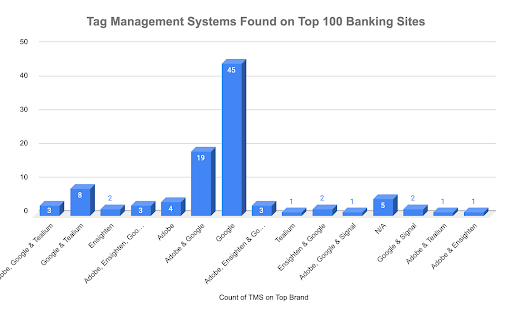

Top Tag Management Systems

Secondly, we took a look at the different tag management systems in place. These TMS’ are the organizers of all the marketing tags on the websites, and they determine what/how tags are firing and where they can send the data they collect to.

From the scans, we found:

- Adobe Launch was loading on 36% of all websites

- Ensighten on 11% of all websites

- Google Tag Manager on 86% of all websites

- No TMS’ were loading on 5% of all websites

- Signal on 3% of all websites

- Tealium on 16% of websites

The typical mission of a company’s website is to build strong relationships with your customers by having them complete key conversions that would be reciprocated over and over again. Banks (and any organization for that matter) are able to do so through using different marketing/analytics tools to collect information about their customers behavior with their website and online advertisements.

Having said that, the more platforms used means more platforms are trying to collect information when a page loads, meaning slower loading times on the website. Slower loading times ultimately can impact the odds of building long-term relationships, since nobody enjoys slow page load times.

By using a TMS, analytics teams can control where specific tags are placed on the site and when to fire, which could lead to improving the site’s overall performance. To see what you have today, conduct an audit of your website to see which TMS you are using and how it’s setting tags. If you have more than one TMS, consider migrating to using one since it’s redundant to have multiple TMS’ fighting to have their tags load first. From here, you can make the necessary changes to optimize your TMS usage.

In light of the privacy-centric future approaching us, we are beginning to see more organizations implement server-side tag management as an alternative to standard client-side tag management. Besides having the benefit of reducing the amount of tags loading on the site which can impact the site’s performance, teams also have more control over the data they share with other platforms. This helps from a data governance perspective because you can ensure that certain data points, especially personal identifiable information (PII), is not being sent to any third-party platforms.

We would suggest reaching out to an expert like InfoTrust to help answer questions and potentially support configuring your client-side or server-side TMS, sharing best-in-class practices, or even leading your tag management/governance process, i.e. helping you identify and update what tags are being deployed within your TMS.

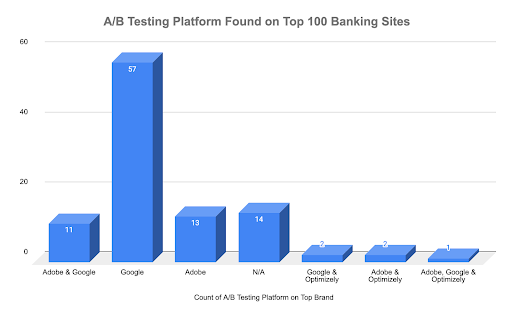

Top A/B Testing Platforms

The next grouping of platforms we observed are platforms that run different tests and show if one variation performs better than the other, A/B testing platforms.

With Tag Inspector, we found:

- Adobe Target was found loading on 27% of all websites

- Google Optimize on 71% of all websites

- No A/B testing platform was on 14% of all websites

- Optimizely on 5% of all websites

Compared to last year, it appears more organizations are beginning to use an A/B testing platform. This makes sense due to the death of the third-party cookie. As banks (and all organizations) won’t be able to rely on those cookies to identify unique users and track/target them, analytics teams need to find unique ways to convince their audiences to share their information so that they can be identified and, in turn, given a more personalized online experience with the bank of their choice.

With an A/B testing platform, teams have the ability to run multiple tests at a time and better understand which page/button/option audiences tend to have a positive interaction with more. From there, they can continue to build on the positive interactions and test new options that will ultimately point out the top journeys that audiences follow that lead to them fulfilling the conversion, whether that be sharing their user information or, in the case of banks, making a deposit.

As you consider looking/testing different A/B testing platforms, these are the factors that we would recommend considering:

- How easy is it for us to implement this platform?

- Who on our team is qualified to use the platform?

- What are the features that each platform offers and doesn’t offer?

- What can the platform integrate with? I.e. analytics platform to focus on important audiences

- Am I able to demo the product before purchasing?

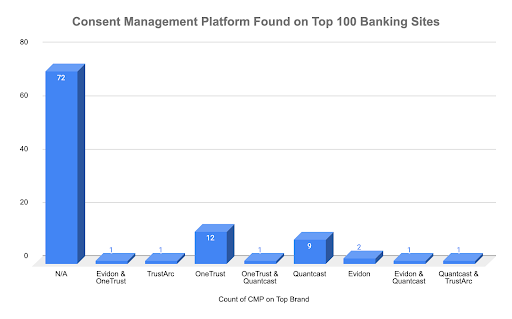

Consent Management Platforms

The fourth platform that we took into consideration for this analysis was the consent management platform (CMP). A CMP’s purpose is to capture and remember the different consent levels that customers give when they come onto the website, and continue to follow those preferences for future visits from the same users. Have you ever noticed those banners that pop up and ask if you accept cookies or reject them? That’s typically a CMP.

From our analysis, we found that:

- Evidon was found loading on 4% of all websites

- No A/B testing platform was on 72% of all websites

- OneTrust on 14% of all websites

- Quantcast on 12% of all websites

- TrustArc on 2% of all websites

Our team was astonished to find that almost three-quarters of the leading U.S. banks don’t have a CMP in place today. As we continue down the road to the future of privacy, it’s becoming more clear to customers that their data is being used for targeting and marketing purposes. Thanks to online regulations, customers can now request all organizations to share what information they collected about said customers and how they’re using it.

Audiences also have the ability to tell these organizations to not collect any more information about them and to delete any data they have on the audiences. If these banks aren’t able to fulfill these requests, they can face large fines. Just look at Sephora and their $1.2 million fine!

CMPs allow your team to rest and be at ease, as they have the ability to remember your users’ preferences when they visit. You also have the ability to customize the banner that pops up when a user comes onto the website, giving your customers transparency on what their data is used for. By doing so, you’ll give them the trust to continue to come back and, potentially, update their preferences on what you can collect.

If you’re currently using or looking into investing in a CMP, consider these recommendations:

- If looking at a CMP, consider relying on a third-party partner to understand the main players’ features, benefits, and how they align with your business objectives.

- If using a CMP, consider re-evaluating its current implementation. Are you just setting consent preferences to check the box or do they match with the different user experiences you’re proposing?

- Take the learnings from your CMP to improve your digital experience online, thus potentially gaining more of your customer’s trust to track and analyze their online behavior.

- Consider running a tag monitoring platform alongside your CMP to give a unified approach to monitoring consent.

Total Martech Platforms

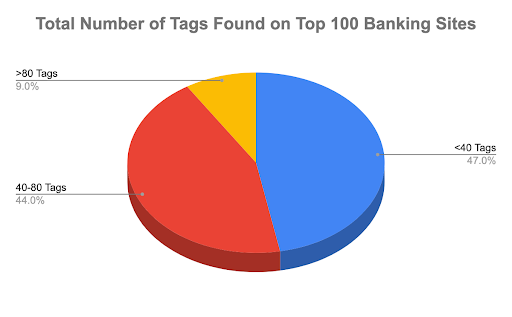

Finally, let’s take a look at the total amount of marketing platforms that each of these banking institutions are using today to analyze their customers online behavior.

From the analysis, we found that:

- 47 banking websites had less than 40 marketing tags loading

- 44 had between 40-80 marketing tags loading

- 9 had more than 80 marketing tags loading (one website had a total of 129!)

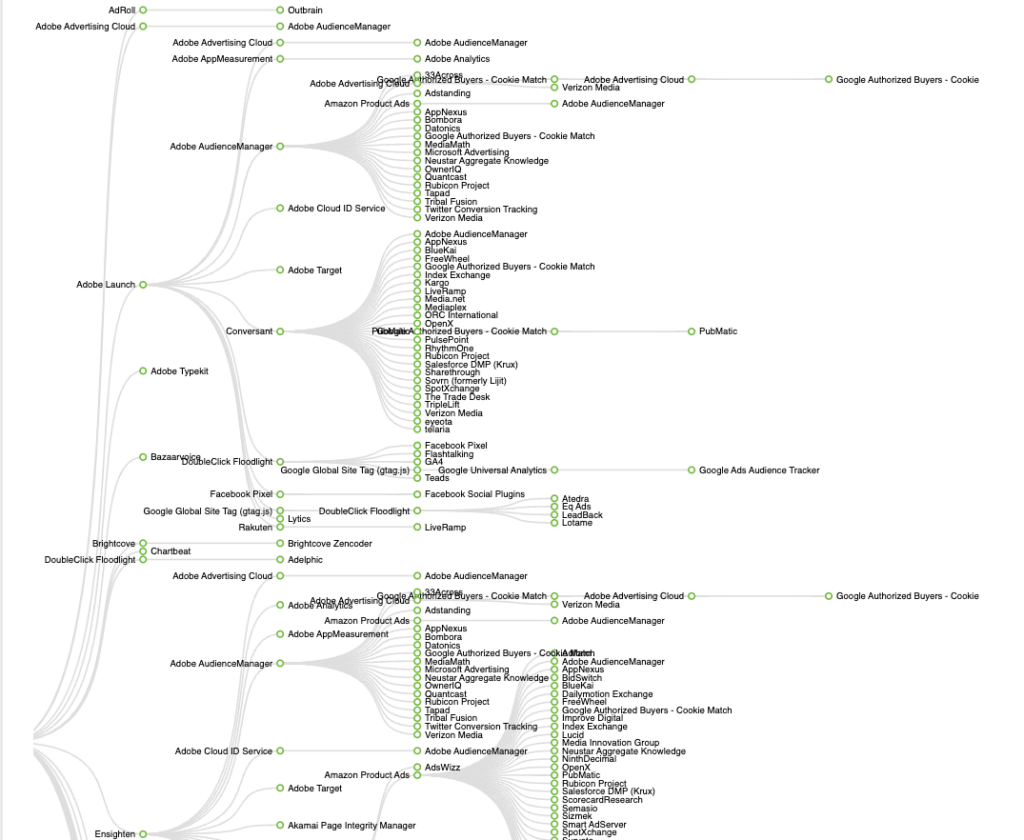

The way that these marketing platforms were loading on the sites were via the page source, through one of the tag management systems mentioned above, or through a process called piggybacking (when one marketing platform loads off another marketing platform).

I don’t believe we need to make it any more clear about what the future holds for all organizations alike (third-party cookie deprecation, online privacy regulations, and increased user awareness). The more tags/platforms loading on your website collecting data parameters and setting first-party cookies, the more challenging it will be to maintain a privacy-centric architecture. Take a look at one of the bank’s architecture today:

One of the ideas that we’re preaching to our current and potential partners alike is the idea of data minimization. By only collecting data that you truly need to make decisions and not just collecting for the heck of it, banks will have a much cleaner architecture to maintain. On top of that, they’ll reduce the risk of being non-compliant with privacy regulations and providing negative user experiences.

If you haven’t already, conduct a full martech audit of all the websites your organization owns. Some of the criteria you should be looking for include:

- All platforms being used across the sites

- All data points being collected by said platforms (especially if any of those data points are PII)

- All cookies being set by said platforms

After conducting this audit, the next step will be to review the current processes that your organization has in place for ongoing monitoring of your tagging architecture, i.e. do you use a platform like Tag Inspector to monitor and alert your team on your behalf?

We would also recommend you consider working with a partner like InfoTrust that understands and sees the landscape to develop a privacy-centric roadmap with actionable steps. By doing so, you’ll be ahead of the curve and doing what truly matters—giving your users the best online experience.

Conclusion

From this analysis, we were able to share what the top banking institutions are using today to measure and track their audiences, as well as provide actionable steps that your organization can take away and begin implementing.

Having shared all the above, there are a few things to keep in mind:

- There is no one digital architecture that fits all banking or any company needs. What it comes down to is what data is needed to understand their audiences, and from there, which people and platforms will allow them to gather those insights.

- Adding a new platform to your martech will not solve all of your problems, but it can be used as a powerful piece. That is, if you have the expertise to implement and maintain.

- The winning combination will not be found right away; there will be a lot of testing and learning over the foreseeable future. Be open to the successes and failures.

If this analysis has inspired you to take the next step into preparing for the future, contact us to see if our expertise could be a key component in achieving that goal.